Calculate federal withholding per paycheck 2023

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Get Started With ADP Payroll.

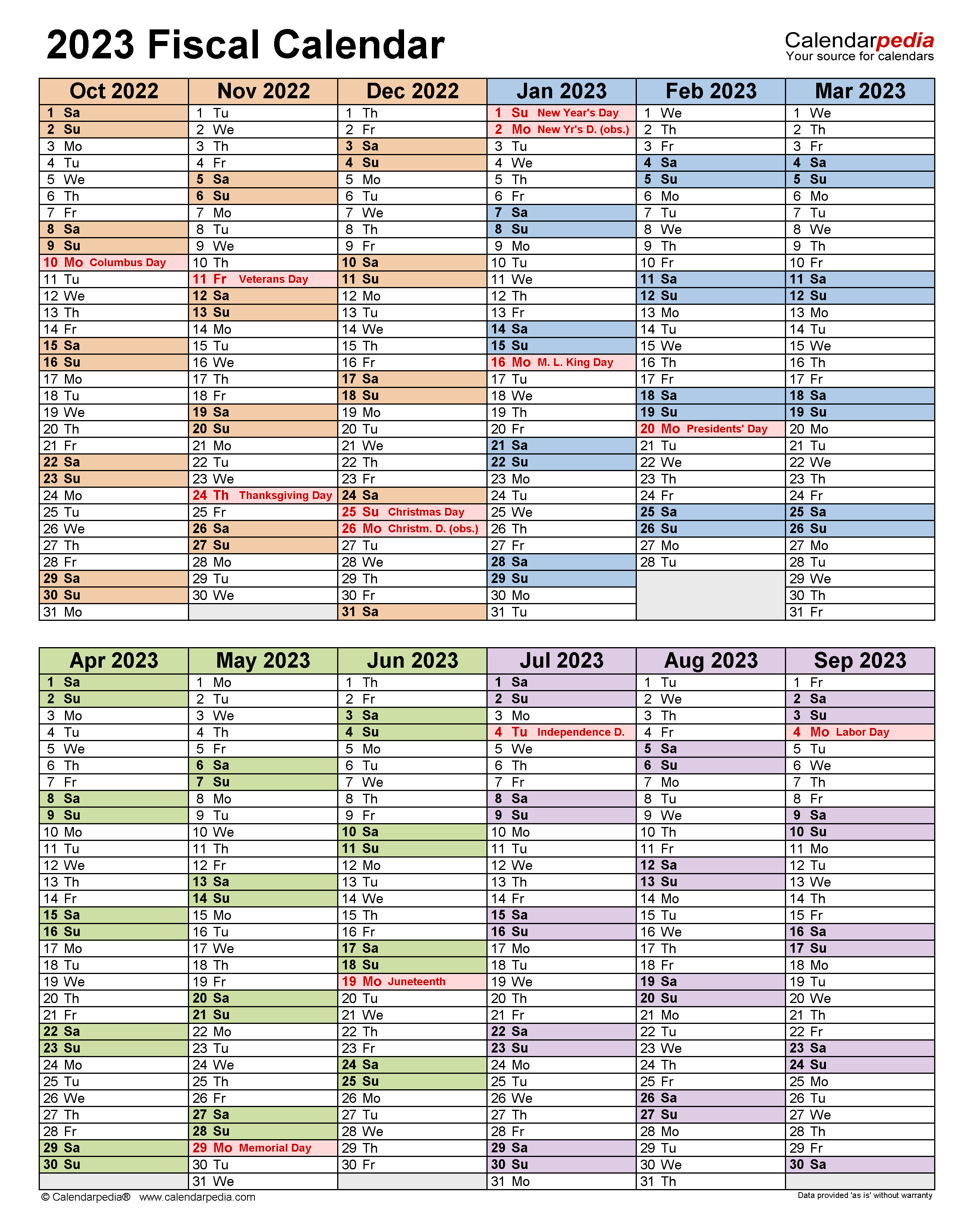

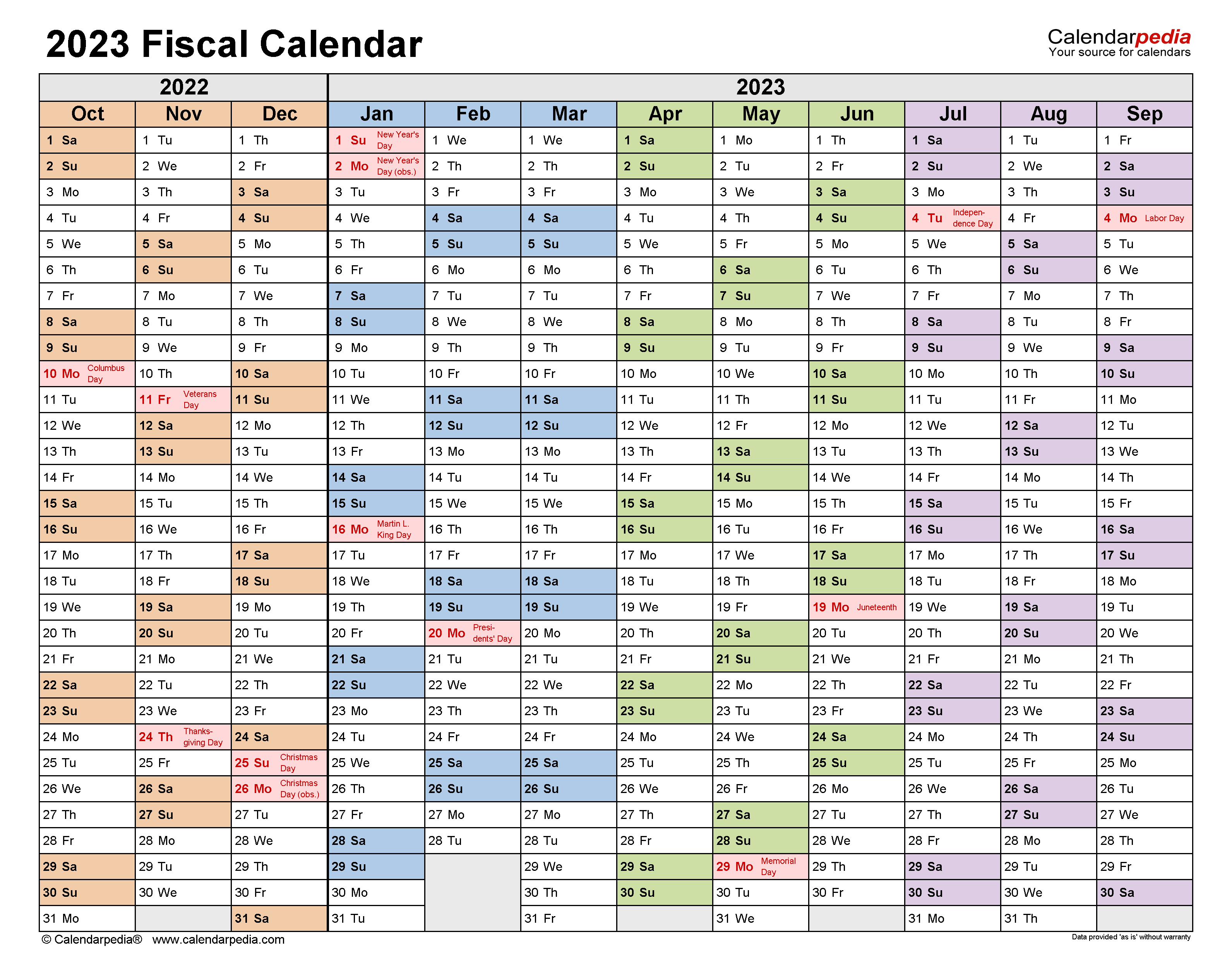

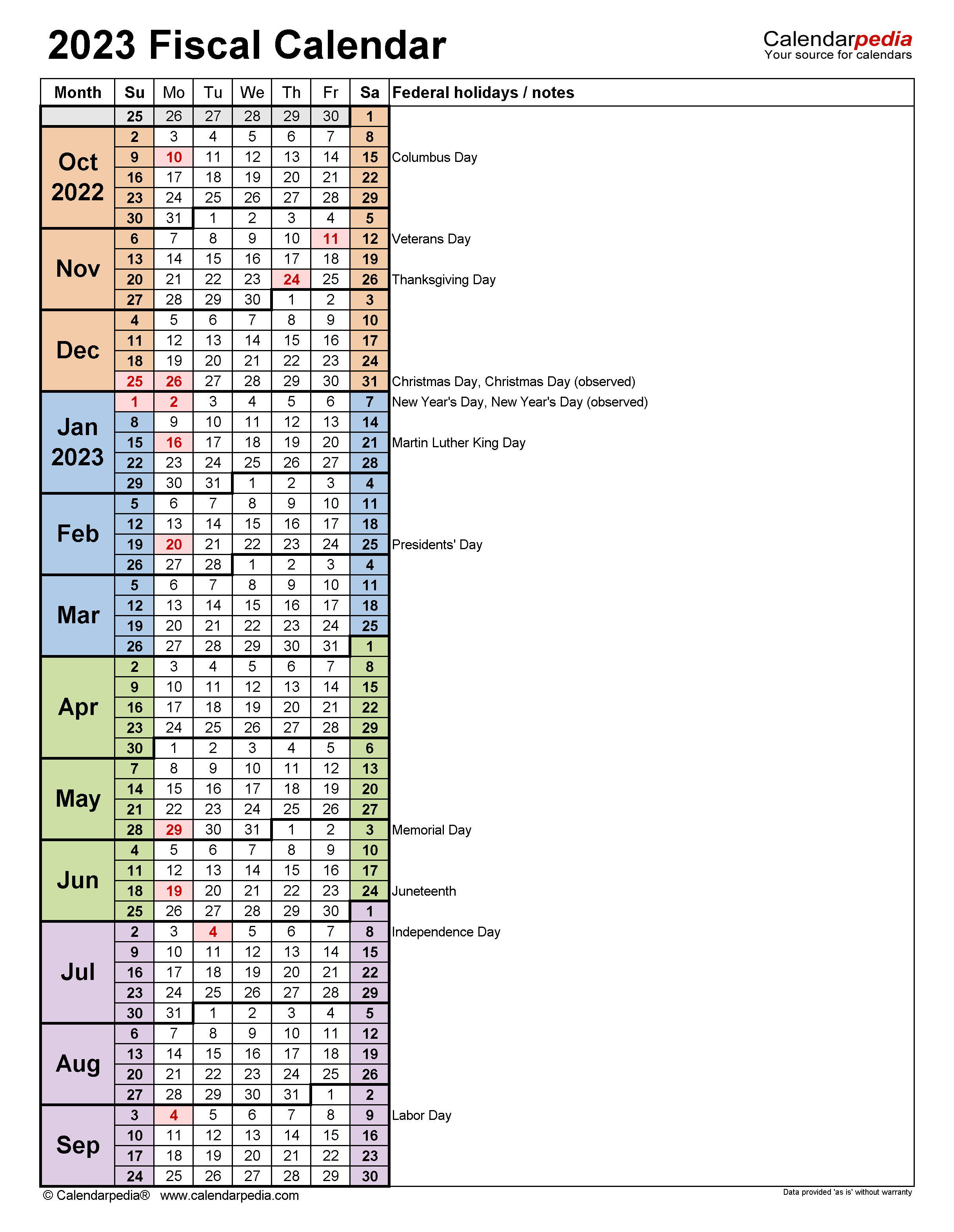

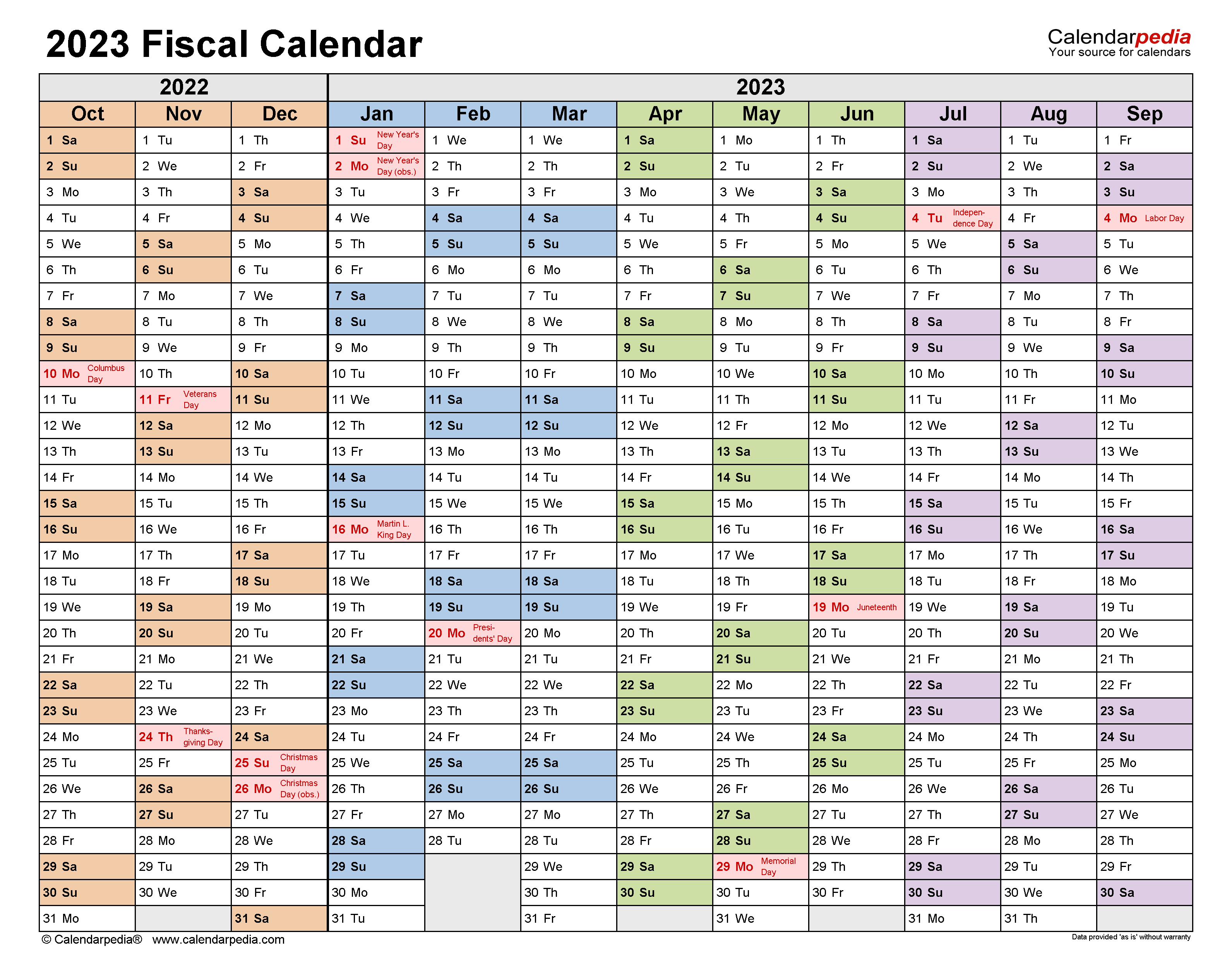

Fiscal Calendars 2023 Free Printable Pdf Templates

250 minus 200 50.

. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Subtract 12900 for Married otherwise.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Prepare and e-File your. There are two main methods small businesses can use.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. We refer to the amount of wages taken from your paycheck for.

Prepare and e-File your. 250 and subtract the refund adjust amount from that. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees.

Each April many taxpayers are surprised as they realize that they have either over withheld or under withheld on their taxes. It will be updated with 2023 tax year data as soon the data is available from the IRS. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Estimate your federal income tax withholding. Estimate your federal income tax withholding.

Calculate federal withholding per paycheck 2023 Minggu 11 September 2022 Subtract 12900 for Married otherwise. For employees withholding is the amount of federal income tax withheld from your paycheck. Use this tool to.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators. This Tax Return and Refund Estimator is currently based on 2022 tax tables. How to calculate annual income.

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

The amount of income tax your employer withholds from your regular pay. Federal withholding calculator 2023 per paycheck Minggu 11 September 2022 Edit. For example if an employee earns 1500.

See how your refund take-home pay or tax due are affected by withholding amount. Based on your projected tax withholding for the year we can also estimate your tax refund. 2022 Federal income tax withholding calculation.

Then look at your last paychecks tax withholding amount eg. Our 2022 GS Pay. Use this paycheck withholding calculator at least annually to.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Ad Compare This Years Top 5 Free Payroll Software.

Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. Welcome to the FederalPay GS Pay Calculator. Lets call this the refund based adjust amount.

Three types of information you give to your employer on Form W4. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

How It Works. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Free Unbiased Reviews Top Picks.

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

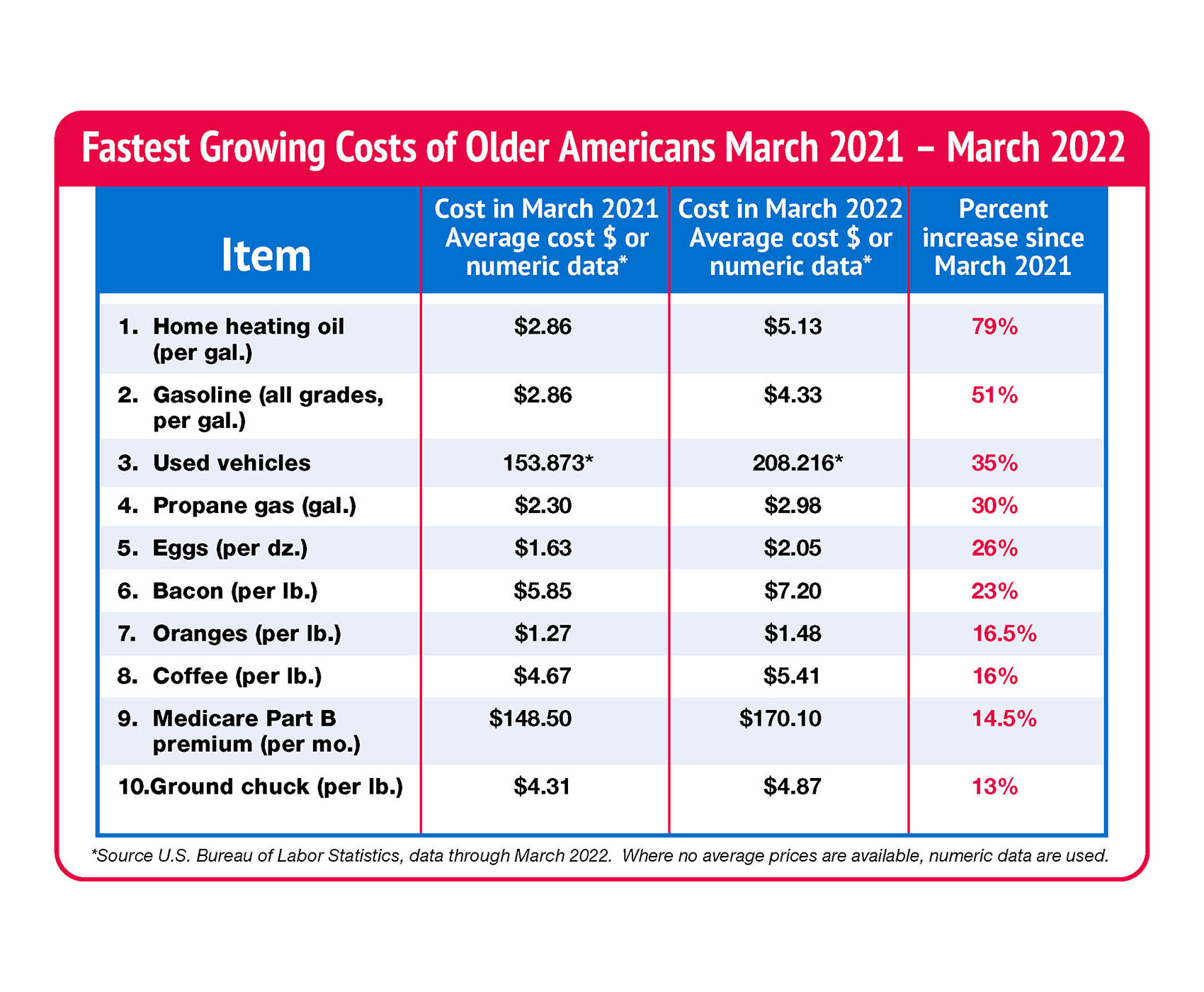

Social Security Benefits Lose 40 Of Buying Power Cola For 2023 Could Be 8 6 The Senior Citizens League

2022 2023 Tax Brackets Rates For Each Income Level

Social Security What Is The Wage Base For 2023 Gobankingrates

Lawmakers Push For 5 1 2023 Federal Pay Raise Fedsmith Com

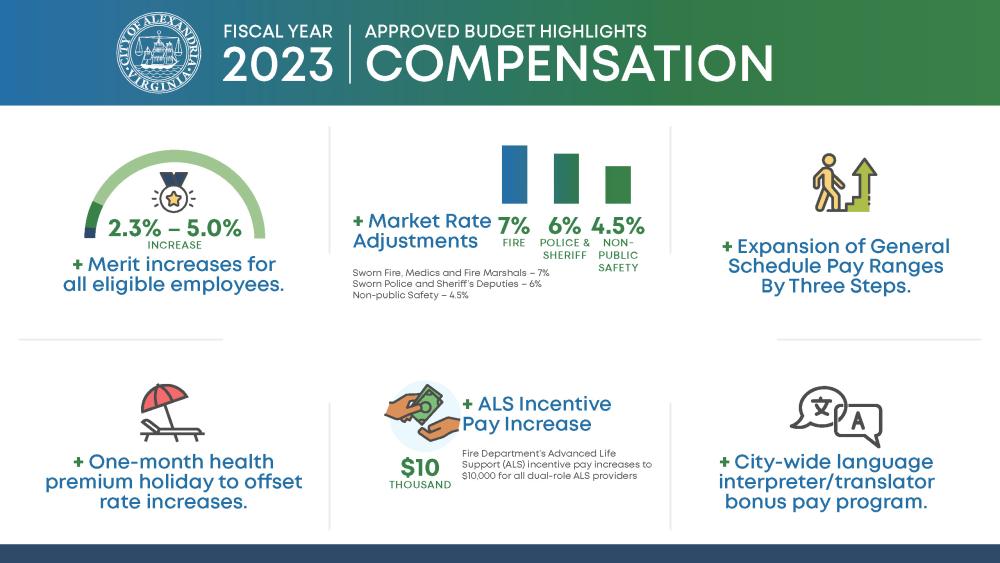

Management And Budget City Of Alexandria Va

2022 2023 First Day Of School Signs Freebie Preschool Through Seventh Grades School Signs Kindergarten First Day Last Day Of School

2022 Eligibility Tables Vermont Health Connect

Fiscal Calendars 2023 Free Printable Pdf Templates

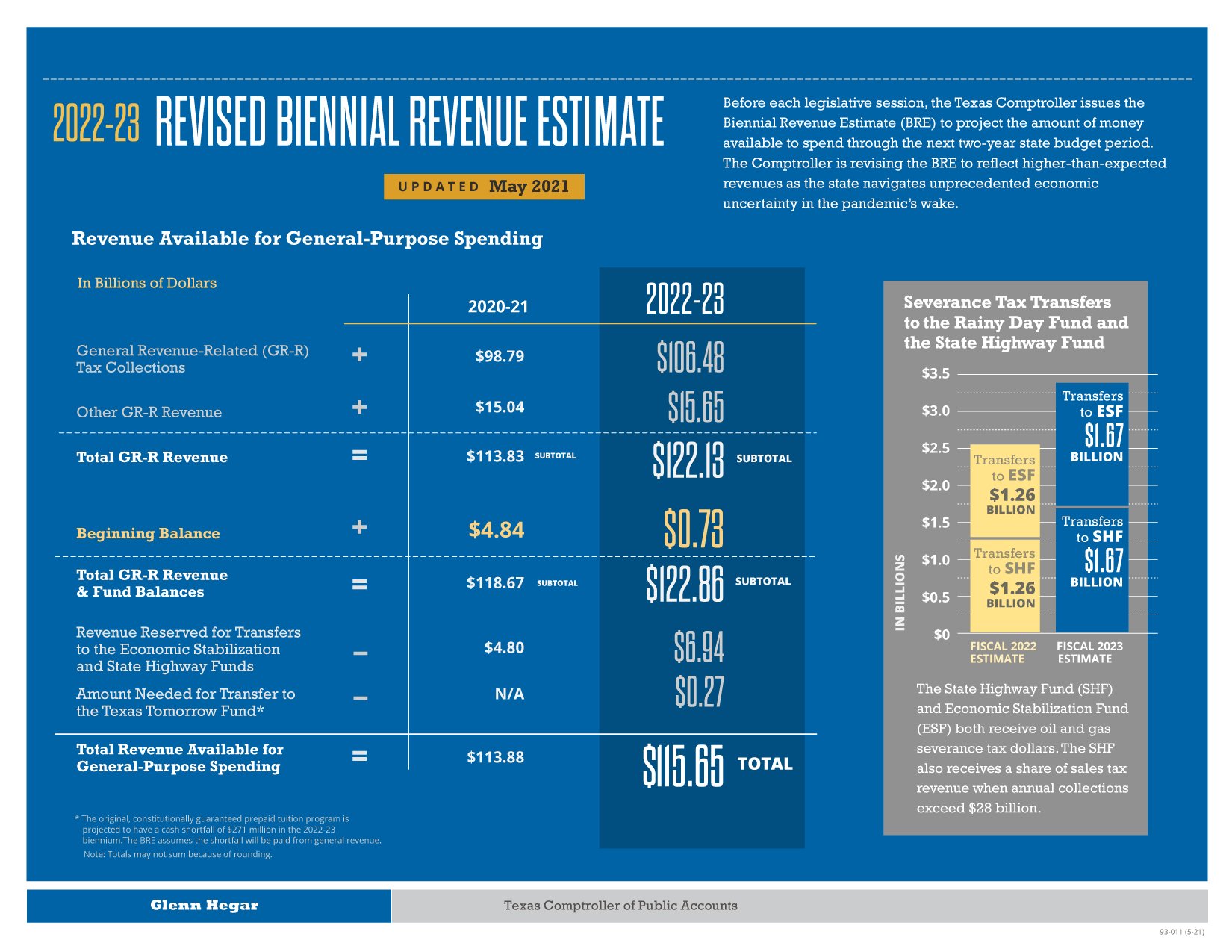

Biennial Revenue Estimate 2022 2023

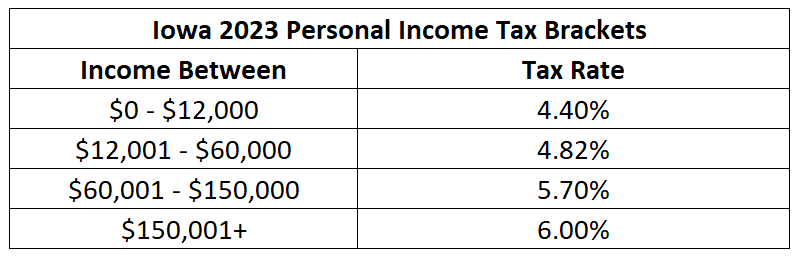

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

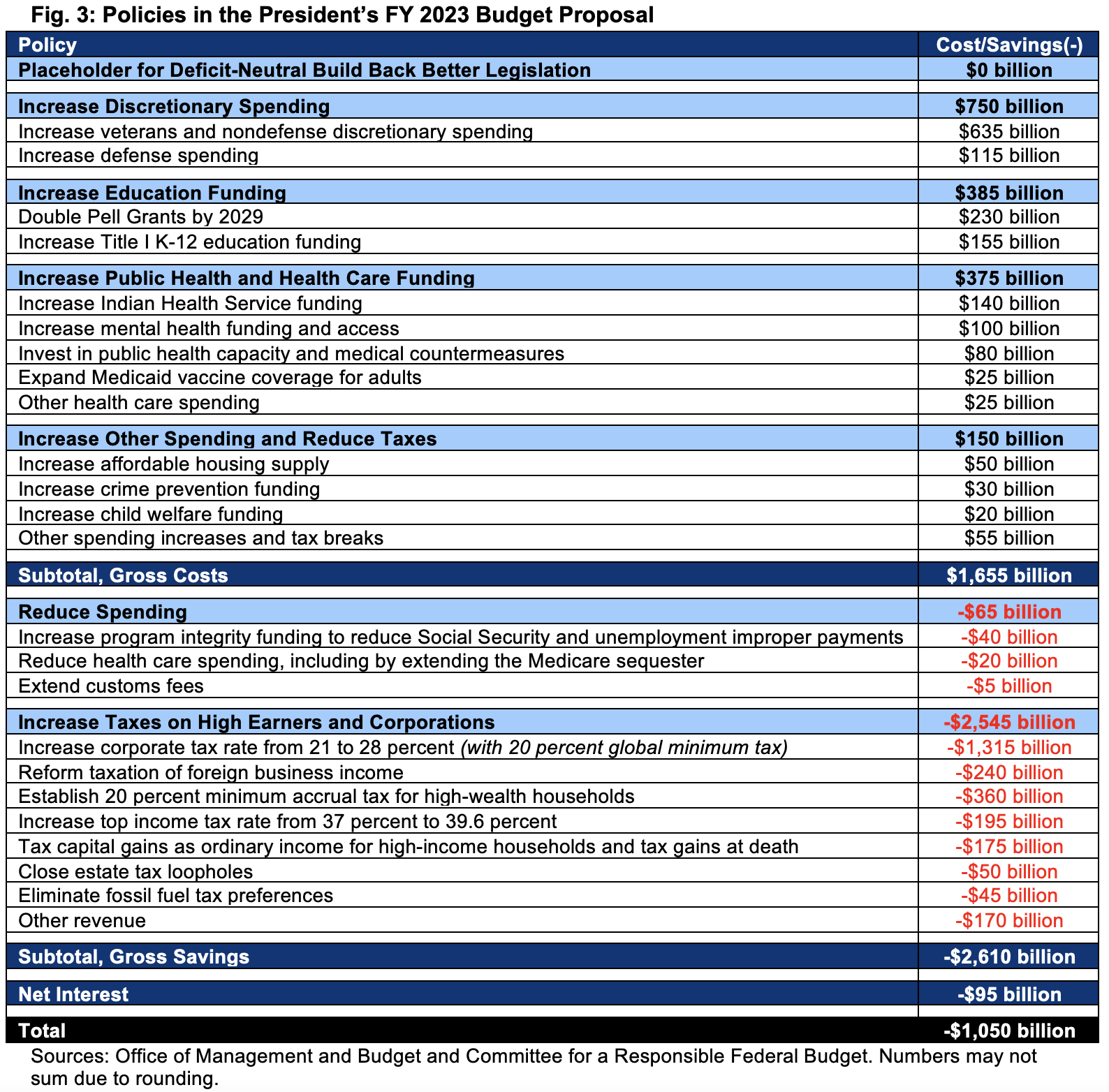

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

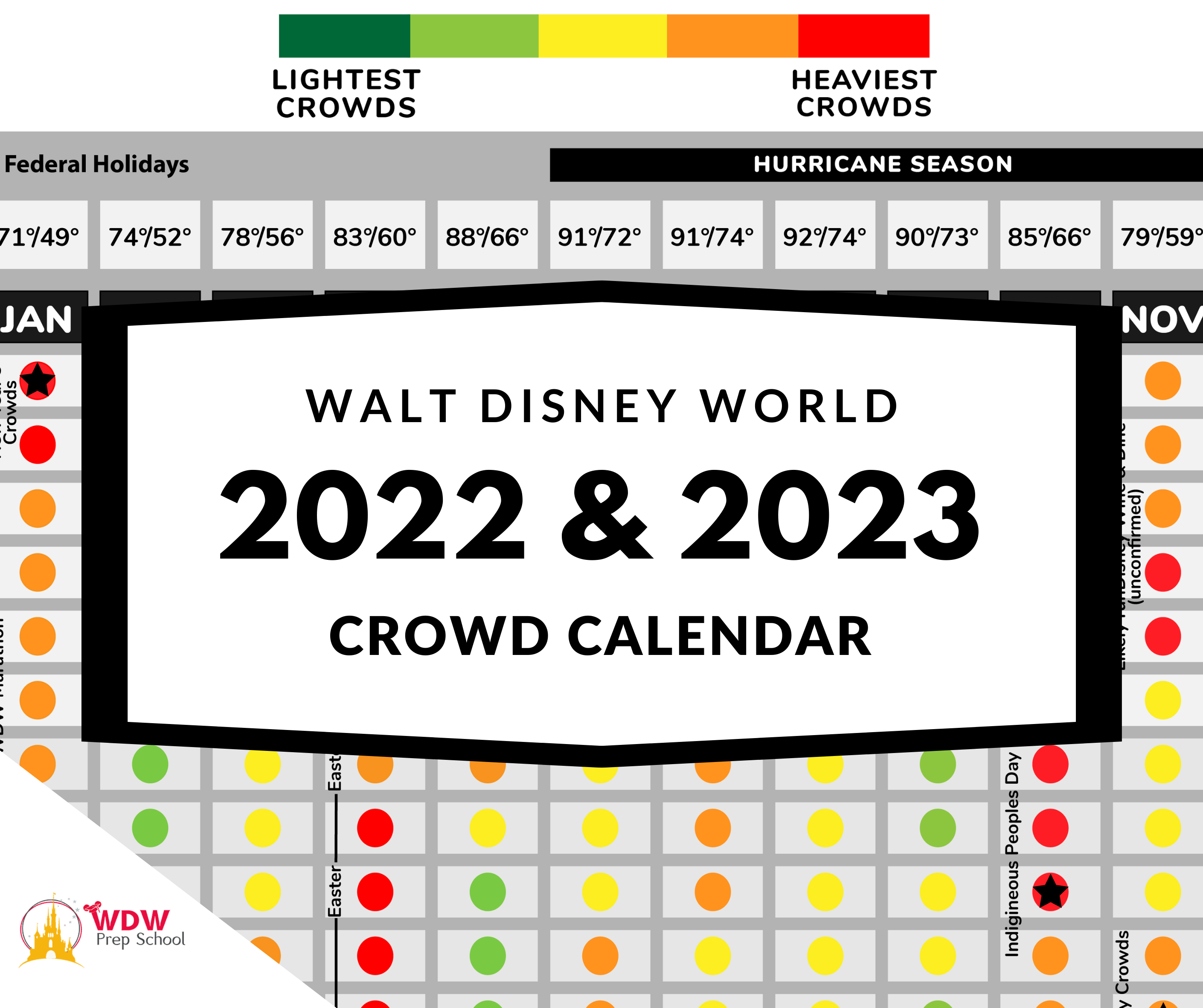

Disney World 2022 2023 Crowd Calendar Best Times To Go

Could 2023 Social Security Cola Hit 9 Benefitspro

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Fiscal Calendars 2023 Free Printable Pdf Templates

2023 Military Pay Chart 4 6 All Pay Grades